Janet Kes (ARN) on the new European Battery Regulation from 2023

“Everything points to the fact that things are really going to change”

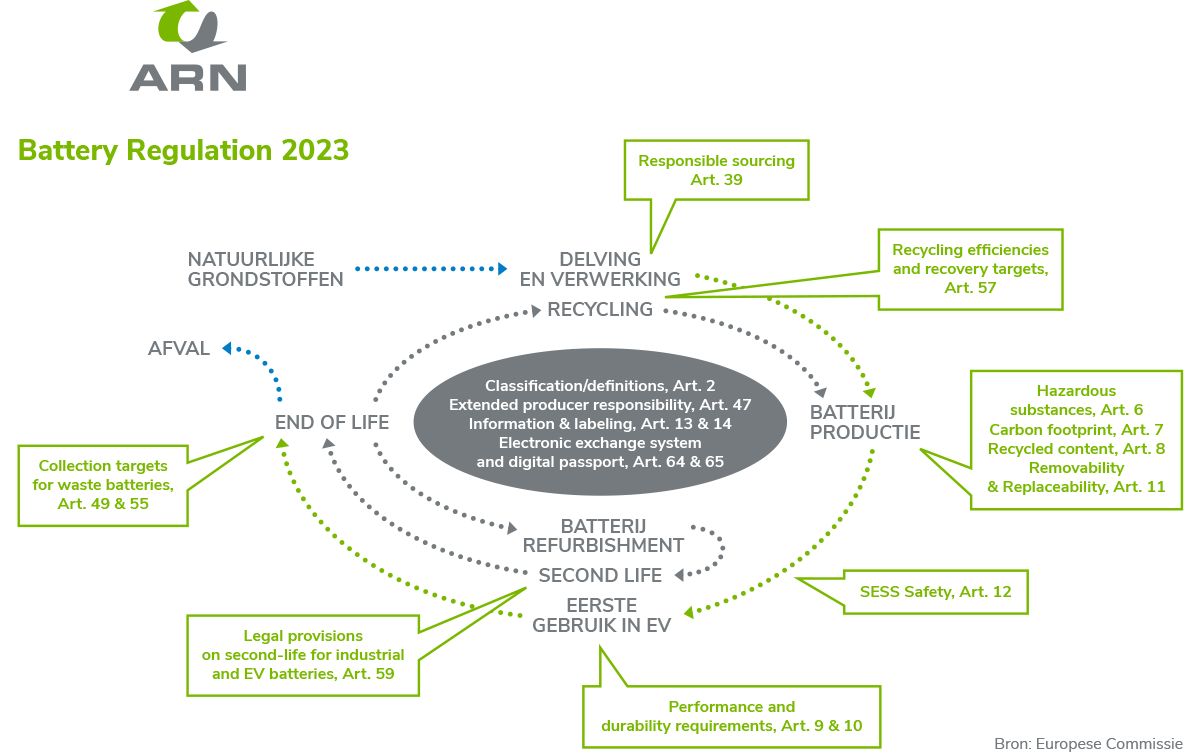

Europe is making progress in the field of battery strategy, and that includes automotive drive batteries. On 1 July, 2023, the new Battery Regulation, the successor to the current Battery Directive, will come into force. This will include stringent rules for the registration, collection and recycling of drive batteries. It will provide more insight and safety and keep valuable raw materials within Europe. ARN battery specialist Janet Kes looks ahead.

The Battery Regulation has been available in draft form since December 2020. The successor to 2006’s Battery Directive has clearly extended its scope beyond recycling and the associated responsibilities on producers. The Regulation has three main goals:

– bolster the way the internal market for batteries functions;

– provide an impetus for realising the objectives of the circular economy;

– reduce the environmental and social impact in all phases of the battery life cycle.

In addition to bringing the 2006 Battery Directive up to date, the new Battery Regulation also has to provide substance to address the strategic plans of the EU in the field of batteries, the circular economy and sustainable smart mobility. The Regulation therefore focuses on the complete life cycle of a battery.

Strategic importance

In this context, much more attention will soon be paid to aspects such as carbon footprint, recycled raw materials in new batteries, safety, performance and information about the battery in the complete chain (battery passport). Furthermore, in the Battery Regulation end-of-life management becomes an integral part of the chain, which translates to increased responsibilities for all economic actors in it.

The new European Battery Regulation is strategically very important. By 2030, the global market for drive batteries will grow to an estimated €130 billion. Moreover, raw materials are scarce, so if Europe wants to realise climate targets and secure a sufficient supply of drive batteries, now and in the future, it will be vital to obtain and maintain a firm grip on material flows.

From “Directive” to “Regulation”

The new Battery Regulation is well-timed, says Janet Kes, Manager Batteries and Quality Assurance at ARN. The new proposals pertain to a “Regulation” one that would be effective directly from a Europe context, without the need for national implementation. It would also be effective immediately and provide clarity and legal certainty throughout the battery chain. All this should then pave the way for the substantial investments that will be needed in the battery market.

By virtue of its membership of Eucobat – the European association of national collection schemes for batteries – ARN provided input for the formulation of the Battery Regulation.

New category

Battery technology in vehicles is an important factor in the realisation of climate goals. Given its enormous growth, it has justified the designation of a new battery category: drive batteries for electric vehicles, for which specific objectives and requirements will also be applicable. This new category comes on top of the three existing categories: portable batteries; (car) starter batteries; and industrial batteries. In the current Battery Directive, drive batteries fall under industrial batteries.

Battery passport

To keep track of material flows from batteries, “registration” will be the buzzword in the new Regulation. “The intention is to develop a European registration system for, among other things, drive batteries from electric vehicles,” explains Kes. “The resulting ‘battery passport’ will contain all relevant information for the chain, such as the battery’s carbon footprint and material composition. This information is relevant for the recycling of the battery. Currently, we still record the information per vehicle make and type ourselves. For transport purposes, you need the exact external dimensions of the battery, for example, while processors will need information about its chemical type and composition.”

Reuse

The new Regulation also sets more ambitious targets for material reuse. As a step towards attaining more circularity – these include targets for the use of recyclates in the production of new drive batteries. “This mainly pertains to precious and scarce materials, such as cobalt and manganese.”

Second life

Thanks to the financial stimulus it gives its residents to embrace electric driving, the Netherlands has a relatively large electric-vehicle fleet. “The Netherlands is one of just two European countries in which the popularity of e-driving has really taken off. In the context of the End-of-Waste Regulation, the Netherlands has several companies that can give end-of-life batteries a second lease of life in other, stationary, uses. This marks the end of the producer’s responsibility for the battery’s first life. For its second life, that responsibility is passed on to a new producer. It simplifies the way the life of used batteries is extended for alternative applications.”

Specialist recovery techniques

So does all this mean that, thanks to the new Regulation, the drive battery will soon become circular? “The Regulation is still in draft form,” cautions Kes, “but everything points to the fact that things are really going to change. There is clear momentum in what is a strongly developing market. Of those batteries that are not suitable for a second life, at the moment we recycle more than 70 per cent by weight. To drive up that figure, there are currently many initiatives in Europe to increase recycling efficiency to well above 90 per cent. We have the processing technology to do it, but it’s not yet available in insufficient capacity. The Regulation offers a framework of rules that should stimulate this market.”

High-value residual materials

And is the new Regulation likely to change the current working method for end-of-life batteries? In a logistical sense, Kes doesn’t expect so. “We will still have to pick up batteries individually packed from the dealer or the car-dismantling company. With the increase in volume, it might change because we’ll be able to pick up a number of batteries at the same time from one location – taking into account the importance, in terms of safety, of limiting the storage time of end-of-life batteries as much as possible. In future, we expect the increase in the volume of collected batteries to lead to a decrease in processing costs. If the demand for materials recycled from old batteries increases, it may even become a source of income for the recycling company. Manufacturers will almost certainly try to influence the material flow, because they might want the batteries to go to specific processors, for example. That has never been the case with other materials. At ARN, we have never known a manufacturer to insist that oil or tyres, for example, be taken to a specific processor. But when it comes to drive batteries, things will really change. Getting and keeping a grip on the critical materials from old batteries will become very important for the production of new batteries.”

“Getting and keeping a grip on the critical materials from old batteries will be key for the production of new batteries”

Janet Kes, ARN

Car dismantling companies

Electric vehicles signal a different way of working for car dismantling companies. “The Regulation stipulates that batteries must be returned to the manufacturer or to a processor contracted by the manufacturer,” says Kes. “This has positive ramifications for safety, traceability and liability. Moreover, it’s important to regulate the sale of end-of-life batteries. They are and remain, after all, a high-voltage product that must be handled safely and responsibly. And the channelling of damaged batteries, for use in the home for example, is potentially risky if you do not have specialised knowledge. As the selling party, the car dismantling company is then partly responsible.”

Opportunities in the electric future

Kes still thinks the electric future will offer undiminished opportunities for car-dismantling companies to earn a good living from drive batteries. “In the Netherlands alone, approximately 200,000 cars are currently powered by drive batteries. If, as the draft of the Regulation currently stipulates, batteries have to ‘remain within the manufacturer’s sphere of influence’, this can easily be delegated to an importer or an organisation like ARN in collaboration with specialised car-dismantling companies. There are already car-dismantling companies that, with our help, train their employees properly, and arrange safe storage along with the correct equipment and protection. In this way they will already meet the requirements that the Regulation will impose on registration: safe storage, expert and safe dismantling and further logistics and processing. If a car-dismantling company has all those ducks in a row, it will be a good collaboration partner.”

Sustainable Development Goals

For the fourth year, ARN has measured itself against the benchmarks of the Sustainable Development Goals (SDGs) in the context of being “lean and green”. The SDGs depicted here apply specifically to the content of this page.